World Bank Cuts Global Growth Outlook as Trade Tensions Rise

The World Bank has lowered its global growth forecast for 2025 to 2.3%, down by 0.4 percentage points. The downgrade reflects the growing economic impact of trade tensions, higher tariffs, and increased uncertainty, which are affecting economies worldwide.

Widespread Forecast Downgrades

In its Global Economic Prospects report, the World Bank reduced growth projections for nearly 70% of countries. This includes major economies like the US, China, and members of the European Union. The bank also cut forecasts across six key emerging market regions.

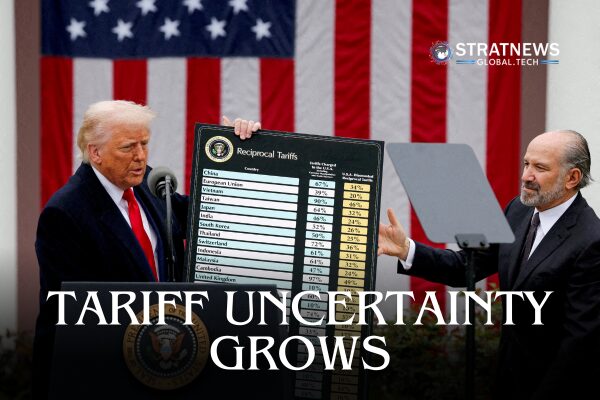

Trade tensions have played a central role in these downward revisions. Under US President Donald Trump, tariff levels have risen sharply, reaching their highest in nearly a century. These increases have provoked retaliatory measures from countries like China, further disrupting global trade.

Although the World Bank did not predict a recession, it stated that 2025 could see the weakest global growth outside of a recession since 2008. From 2023 to 2027, average global GDP growth is expected to reach only 2.5%, marking the slowest decade since the 1960s.

Trade and Inflation Pressures

The report also projected that global trade would grow by just 1.8% in 2025. This is down from 3.4% in 2024 and far below the 5.9% average seen in the 2000s. These figures do not account for new tariffs announced in April, which may still come into effect in July.

Inflation is forecast to remain elevated at 2.9% in 2025. This is due to ongoing tariff increases and tight labour markets across several countries.

The World Bank warned that further trade barriers could hurt global growth even more. A 10 percentage point rise in US tariffs, along with proportional retaliation, could lower 2025 growth by another half-point. This would likely cause trade to stall, weaken investor confidence, and shake financial markets.

Signs of Hope Despite Headwinds

Despite the gloomy outlook, the World Bank noted that a global recession remains unlikely, with a probability below 10%.

Talks between the US and China in London offer some hope of easing trade disputes. These discussions now include topics such as rare earth mineral restrictions, which pose risks to supply chains and economic stability.

Ayhan Kose, Deputy Chief Economist at the World Bank, likened uncertainty to “fog on a runway,” saying it slows investment and clouds economic outlooks. However, he noted signs of progress, including shifting supply chains and emerging trade partnerships. He also mentioned that artificial intelligence could provide a modest boost to future growth.

Trade may gradually recover in 2026, with an expected growth rate of 2.4%.

Varied Impact Across Countries

The World Bank reported that growth prospects have worsened most significantly for advanced economies. Their combined growth is now forecast at 1.2% for 2025, down from 1.7% in 2024. The US outlook was revised to 1.4%, down 0.9 percentage points from January, with further reductions expected in 2026.

However, the White House challenged the bank’s projections. A spokesperson highlighted strong Q1 2025 investment and rising personal incomes, adding that upcoming tax reforms could boost growth.

Elsewhere, the euro zone and Japan both saw their forecasts cut to 0.7%. Emerging markets are now expected to grow at 3.8%, slightly below earlier estimates.

Developing countries, especially those outside China, face the biggest challenges. Their per capita GDP in 2027 may still lag 6% below pre-pandemic levels, and recovery could take up to 20 years.

Mexico, heavily reliant on US trade, saw a steep downgrade of 1.3 percentage points, bringing its 2025 growth forecast to just 0.2%.

China’s outlook remains unchanged at 4.5%, with the World Bank noting that Beijing retains policy tools to support growth.

with inputs from Reuters