Global Investors Panic as Chinese AI Model Shakes Up Tech Stocks

Global investors dumped tech stocks on Monday, rattled by fears that a new low-cost Chinese artificial intelligence (AI) model could threaten industry leaders like Nvidia. This selloff erased $593 billion from Nvidia’s market value, marking the largest one-day loss for any company on Wall Street. The panic followed the release of DeepSeek AI assistant, a free, cost-efficient alternative that has already surpassed US-based ChatGPT in downloads on Apple’s app store.

The tech-heavy Nasdaq index plunged 3.1%, with Nvidia’s shares tumbling nearly 17%. This drop set a new record for a single-day loss in market capitalisation for a Wall Street stock. Other chipmakers also suffered: Broadcom fell 17.4%, while Microsoft and Alphabet dropped 2.1% and 4.2%, respectively. The Philadelphia semiconductor index sank 9.2%, its sharpest decline since March 2020.

DeepSeek Emerges as a Game-Changer

DeepSeek, a Chinese startup, has stunned the tech world with its AI models, offering high performance at a fraction of the cost. The company claims its latest model, DeepSeek-R1, is 20 to 50 times cheaper to use than OpenAI’s ChatGPT. Despite training on less advanced Nvidia chips and spending just $6 million, DeepSeek has garnered praise for its quality and affordability.

Silicon Valley figures, including venture capitalist Marc Andreessen, hailed the development as AI’s “Sputnik moment,” drawing comparisons to the Soviet Union’s space race breakthrough. Andreessen described DeepSeek’s open-source AI as a significant innovation and a gift to the global community.

Market Reactions Highlight Investor Uncertainty

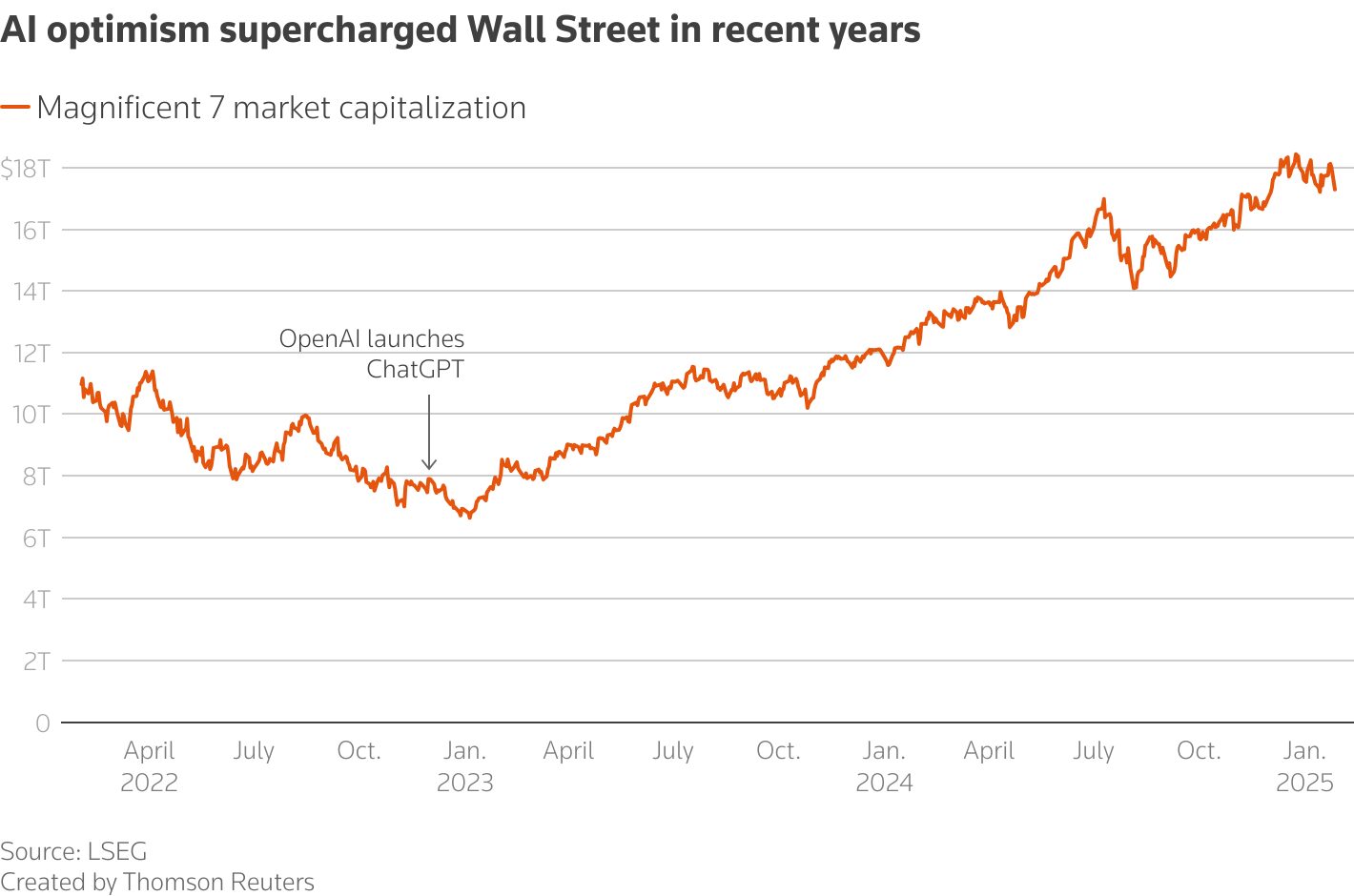

The rapid rise of DeepSeek is seen as a potential threat to the dominance of Nvidia, Microsoft, and other major players in the AI ecosystem. Investors fear reduced demand for advanced chips and large-scale data centres, which have driven AI-related growth in recent years.

However, some analysts believe the selloff was overblown. Daniel Morgan of Synovus Trust Company argued that DeepSeek’s focus on mobile devices and PCs does not pose an immediate challenge to Nvidia’s core data centre market. “The real money in AI lies in providing chips for large-scale operations,” Morgan stated.

Despite Monday’s turbulence, Nvidia shares rebounded 2.5% in after-hours trading. Analysts are cautiously optimistic about the long-term outlook for tech giants, suggesting the recent dip could present buying opportunities for high-quality stocks.

With inputs from Reuters