Axelspace to Join Surge of Space Startups Listing on Tokyo Exchange

Tokyo-based Axelspace is preparing to go public as early as June, according to sources familiar with the matter. The satellite manufacturer is expected to receive approval for its initial public offering (IPO) from the Tokyo Stock Exchange later this month, marking the fifth listing by a Japanese space venture in just two years.

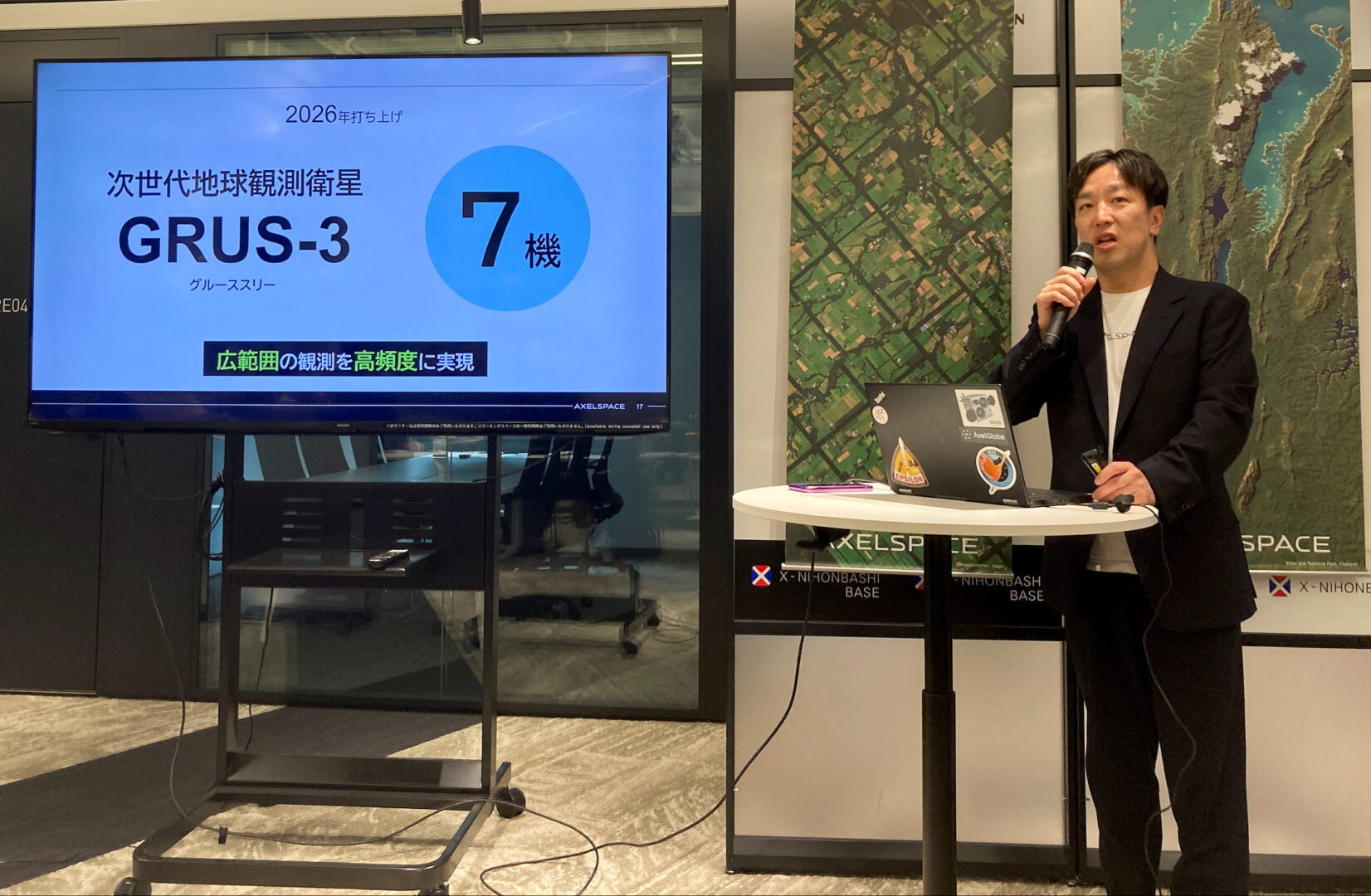

Founded in 2008 by aerospace researcher Yuya Nakamura, Axelspace has launched five Earth observation satellites and built custom satellites for clients such as Weathernews. The company plans to launch seven more satellites next year, further expanding its proprietary data business.

Strategic Growth Backed by Government Defence Spending

Japan’s private space industry, valued at approximately 4 trillion yen ($27.8 billion), has long been dominated by large industrial firms. However, a new wave of over 100 startups is emerging, bolstered by increased government support. Despite most firms being loss-making, Axelspace and its peers are leveraging Japan’s substantial postwar defence build-up as a driver for investment.

The government has committed 600 billion yen over the past two years to its Space Strategy Fund. The aim is to double the industry’s size to 8 trillion yen by the early 2030s. This backing is particularly crucial given the limited fundraising avenues available to Japanese startups compared to their US counterparts.

SMBC Nikko Securities is managing Axelspace’s IPO, although both the firm and the Tokyo Stock Exchange declined to comment. Axelspace, which raised 14.3 billion yen across several funding rounds, counts Mitsui & Co. and ANA among its investors.

Investor Optimism Mixed Despite Sector Growth

Investor interest in space IPOs remains cautious. While companies like Synspective and iQPS have seen their shares climb 50% and 75% respectively since listing, others like Astroscale and ispace have faced market challenges. Analysts note that few companies have shown a clear path to profitability, which limits enthusiasm for additional IPOs in the near term.

“Japanese investors are becoming increasingly rigorous about feasibility,” said Susumu Miyahara, associate partner at KPMG Consulting. This scrutiny is reflected in growing due diligence demands from potential backers.

Nevertheless, listing can bring substantial benefits. It enables broader financing options, improved recruitment prospects, and new partnership opportunities. Still, some like Space BD—Asia’s largest payload service provider for SpaceX—are waiting for clearer market conditions before pursuing an IPO.

As the industry matures, experts predict a pause before a second wave of space listings materialises. Until then, firms like Axelspace are betting on a supportive policy environment to help sustain investor interest.

with inputs from Reuters